Double Entry Book Keeping TS Grewal Class 12 Double Entry Book Keeping (Vol.1) is latest book for Accounting Partnership Firms: Textbook for CBSE Class 12 Student (2024-25 Examination) Salient Features of the book are Below Describe: Class-Tested and Well-Graded Material: Rigorous testing ensures the quality and progression of content. Simple and Lucid Textual Flow: The…

Read morer d sharma class 10 maths book pdf free download

Comprehensive Coverage: Thorough exploration of Class 10 Mathematics topics to establish a robust understanding of fundamental concepts. MCQs for Practice: Extensive sets of Multiple Choice Questions accompanying each chapter for reinforcing learning and honing problem-solving skills. Exam-Ready: Aligned with the latest exam patterns, preparing students for a spectrum of competitive exams and school assessments. Other…

Read morePearson IIT Foundation 24 PDF Download

This book is just release Pearson IIT Foundation’24- Physics+ Chemistry + Maths Class 10 for JEE, NTSE, Olympiad| Revised CBSE|Free access to elibrary & Myinsights Self Preparation – 6th Edition By Pearson ASIN : B0CSSPHS3W Order Now

Read moreGrow with Silkrute to become a Global Seller

Silkrute is an ancient network of trade and cultural transmission extended more than 6500 kms. Indian Speciality reach-out to the world through Silkrute. It was the world’s first information superhighway. However, now this is an e-commerce marketplace to buy Indian Special Products globally. Here, you can buy all Indian Products under one roof at fair prices….

Read moreBlackbook Of English Vocabulary 2024 PDF Latest Edition (2023-2024)

Sl Arora Physics Class 11 PDF Free Download (2024-25 Examination)

Dear Students Reading book habits is a very special enjoyment for a book lover. Today we discussed “Sl Arora Physics Class 11 PDF” You can also download it soon for free here when this PDF version is available online. It is an amazing book if you want to learn physics from scratch and without missing…

Read moreOneCard Credit Card

The OneCard Credit Card offers a hassle-free, rewarding financial experience. Aimed at both newcomers and discerning spenders, it charges no joining or annual fees. Partnered with banks like SBM and South Indian Bank, OneCard provides a premium metallic card with touchless payment capabilities. Unique features include 5X rewards on your top two spending categories each…

Read moreBuild Don’t Talk Raj Shamani

Build Don’t Talk Raj Shamani Pdf Free Download Things You Wish You Were Taught in School right now is not available Pdf. This best book was written by the best Famous author Mr. Raj Sharmani and Published By Penguin Ebury Press the release date of this best book is (25 November 2022) Get Full Book…

Read moreIndian Economy Best Book for Upsc Services Exam Download PDF

Indian Economy Best Book for Upsc Services Exam Download PDF. The 14th edition of Indian Economy by Ramesh Singh, written by a subject expert with multiple volumes on economics, topical articles, and other works to his credit, is still as valuable as ever for students. The book has emerged as an “indispensable companion” for aspirants…

Read moreWhat is Amazon Bazzar | Amazon set to launch Meesho competitor Bazaar in fight for value customers

Amazon plans to wheel cart down value aisle, mirror Meesho model in fashion, lifestyle categories to tap value customers. It competes with Meesho, Flipkart’s Shopsy, and Reliance Industries’ Ajio Street, while also facing competition from Shein, Temu, and Pinduoduo in its home market. Amazon is launching a new vertical featuring low-priced, unbranded fashion and lifestyle products, people aware…

Read moreChief Minister Ladli Behna Yojana – Eligibility Criteria, Benefits, and Final List

A greater level of financial help will now be available to Chief Minister Ladli Behna Yojana recipients, and this decision will benefit around 1.25 crore women. The monthly stipend in Madhya Pradesh has been raised from Rs 1,000 to Rs 1,250 by the government. Chief Minister Ladli Behna Yojana The Madhya Pradesh government’s groundbreaking Ladli Behna Yojana is intended to help…

Read morePM Vishwakarma Registration 2024, Last Date, Benefits, Eligibility @pmvishwakarma.gov.in

The PM Vishwakarma Yojana 2024 registration is open for skilled artisans and workers. To apply, individuals need to visit the official website and submit the required documents. To know full details check below. PM Vishwakarma Registration The PM Vishwakarma Yojana is a government scheme aimed at providing support to artisans and skilled workers in India. The scheme…

Read moreKarnataka Skill Connect Portal 2024: skillconnect.kaushalkar.com Registration

Karnataka Skill Connect Portal:- The first portal in the nation, the Skill Connect Portal, was recently launched by the Karnataka government to connect job seekers and companies through virtual job fairs in honour of World Youth Skill Day. The state government established an “Industry Linkage Cell” in addition to the portal to offer skills and employment…

Read moreDDA e-Auction 2024 on 5th March for Phase 3 of Diwali Special Housing Scheme

DDA e-Auction 2024:- Under the Festival Special Housing Scheme 2024, the Delhi Development Authority (DDA) will begin offering its premium flats and penthouses for e-auction on January 5, 2024. Registration for MIG flats and luxury apartments, including penthouses, opened on November 30 in the evening. Prospective purchasers are responding favorably, and on January 5th, we…

Read moreअमृत भारत स्टेशन योजना 2024: देश के 550 से अधिक स्टेशनों का होगा पुनर्विकास

Amrit Bharat Station Scheme:- भारतीय रेलवे से हर रोज लाखों लोग यात्रा करते हैं ऐसे में भारतीय रेलवे ट्रेन में दी जाने वाली सुविधाओं को और बेहतर बनाने के लिए रेल मंत्रालय ने स्टेशनों के आधुनिकरण के लिए अमृत भारत स्टेशन योजना का आरंभ किया गया है। अमृत भारत स्टेशन योजना के माध्यम से देशभर के लगभग 1000…

Read moreTelangana Rs 500 Gas Cylinder Scheme 2024: How to Apply, Eligibility

elangana Rs 500 Gas Cylinder Scheme:- Launching the Gruha Jyothi initiative, the Telangana government would provide free power for up to 200 units and a gas cylinder for Rs 500. The Arogyasri programme limit was increased, while the Mahalakshmi scheme was already put into effect. Application errors for the Praja Palana programme will be fixed. A…

Read moreOTS Scheme for Property Tax Defaulters in Bengaluru: How to Apply , Eligibility, Benefits

OTS Scheme for Property Tax Defaulters in Bengaluru:- Property tax defaulters in Bengaluru are likely to receive significant relief from the state government’s gazette notification, which was published by H S Shivakumar, the undersecretary of the Department of Urban Development on February 15, Thursday. The decision will benefit several people, including buildings that were exempt from…

Read morePersonal Loan Interest Rates In February 2024

A personal loan, like in other retail loans, are available for individuals who have a steady income and need instant capital to finance their needs. Financial institutions in India offer personal loans and charge a certain interest rate upon the principal amount when the equated monthly installment (EMI) begins. Since the continued impact of retail inflation…

Read moreList of Insurance Companies In India

nsurance Companies in India are recognised by the IRDA – Insurance Regulatory and Development Authority of India, the statutory body promoting and regulating various types of insurance companies in India. Candidates for detailed information on IRDA can check the linked page. This article will abreast candidates with the list of Insurance companies in India. They will get…

Read more10 Best Credit Cards for Cash Back

While experienced borrowers may wonder how many credit cards to have, those who are newer to credit cards or prefer to focus on just one card might have other credit questions on their minds. Often while sifting through pre-approved credit card offers or exploring options on their own, finding the best credit cards for cash back is a priority. Cashback…

Read moreHealth Insurance

WHAT IS HEALTH INSURANCE? Health insurance is an insurance product that provides coverage for expenses in the event of an illness or injury. It can safeguard you from spending your hard-earned money on medical expenses. A health insurance policy can also be viewed as an agreement between you and your insurer. Here, the insurance company…

Read moreGmail की जगह आ रहा Xmail, क्या Google को टक्कर देने जा रहे हैं Elon Musk?

Elon Musk : एलन मस्क ने जब से Xmail लाने की घोषणा की है इसके बाद से यह शब्द X प्लेटफार्म पर ट्रेंड करने लगा. इसको शेयर करते हुए लोग कई तरह के मीम्स वायरल कर रहे हैं. आज के जमाने में जीमेल अकाउंट आम इंसान तक की जरूरत बन गया है. स्टूडेंट्स और प्रोफेशनल्स…

Read moreWhen Is Holi In 2024 In India? | Holi 2024 Mein Kab Hai

So Readers Holi is a lovely and colourful Indian festival that we enjoy for 2 days and holds great significance in Hindu culture in India. Most people are trying to search the 1st of January “When Is Holi In 2024” Every Indian enjoys the victory of good over bad and marks the beginning of the…

Read moreछत्तीसगढ़ राशन कार्ड लिस्ट चेक कैसे करें 2024 | CG Ration Card List

CG Ration Card List को राज्य सरकार द्वारा ऑनलाइन जारी कर दी है । छत्तीसगढ़ के नागरिको को अब कही जाने की ज़रूरत नहीं होगी । राज्य के जिन लोगो ने अपना नया छत्तीसगढ़ राशन कार्ड बनवाने के लिए या पुराने राशन कार्ड का नवीनीकरण करवाने के लिए आवेदन (People applied to get their new ration card…

Read moreRTE Maharashtra Admission 2024-25: Application Form @ rte25admission.maharashtra.gov.in, Last Date, School List

Maharashtra RTE Admission:- The Maharashtra government will start accepting applications for RTE Admission 2024-25 from 23rd January 2024 (Expected). Parents who are interested in applying for the RTE 25% reserved seats may apply online mode. The online application form-filling procedure has already commenced at rte25admission.maharashtra.gov.in. Apply for the admission of your child by following a few easy steps…

Read moreछत्तीसगढ़ राशन कार्ड नवीनीकरण 25 फरवरी तक, मोबाइल ऐप से करें CG Ration Card Renewal

Chhattisgarh Ration Card Navinikaran:- सभी राज्य सरकारों द्वारा समय-समय पर राशन कार्ड नवीनीकरण करने हेतु फॉर्म जारी किए जाते हैं ताकि राशन वितरण की प्रक्रिया में भ्रष्टाचार सम्मिलित ना हो सके। छत्तीसगढ़ सरकार द्वारा राशन कार्ड की नवीनीकरण के लिए अभियान चलाया जाएगा। जिसके लिए 76.94 लाख राशन कार्ड की नवीनीकरण प्रक्रिया 25 जनवरी से शुरू होगी। अगर…

Read more{पंजीकरण} छत्तीसगढ़ पौनी पसारी योजना 2024: ऑनलाइन रजिस्ट्रेशन, एप्लीकेशन फॉर्म

CG Pauni Pasari Yojana:- छत्तीसगढ़ सरकार द्वारा रोजगार के अवसर उत्पन्न करने का निरंतर प्रयास किया जाता है। इसी बात को ध्यान में रखते हुए छत्तीसगढ़ सरकार हैं छत्तीसगढ़ पौनी पसारी योजना का आरंभ किया है। आज हम आपको इस लेख के माध्यम से इस योजना से संबंधित सभी महत्वपूर्ण जानकारी प्रदान करने जा रहे हैं। जैसे कि…

Read moreबिहार बकरी पालन योजना: ऑनलाइन आवेदन, Bihar Bakri Palan Yojana Form

Bihar Bakri Palan Yojana:- बिहार सरकार द्वारा राज्य में रोजगार के अवसर बढ़ाने और बेरोजगारों को रोजगार उपलब्ध कराने के लिए एक नई योजना को शुरू किया गया है। जिसका नाम Bihar Bakri Palan Yojana है। बकरी पालन योजना के माध्यम से राज्य में बकरी पालन को बढ़ावा दिया जाएगा। राज्य सरकार द्वारा बकरी फार्म खोलने के लिए…

Read moreLadli Behna Yojana 10th Installment 1 मार्च को, इन महिलाओं को मिलेंगे ₹1500

Ladli Behna Yojana 10th Installment:- मध्य प्रदेश सरकार सरकार द्वारा लाडली बहना योजना के अंतर्गत अब तक राज्य की 1.29 करोड़ महिलाओं के बैंक खाते में 9 किस्तों का भुगतान किया जा चुका है। और अब लाडली बहना योजना की अगली किस्त यानी Ladli Behna Yojana 10th Installment को लेकर एक बड़ी अपडेट सामने निकाल कर…

Read moreBJP Flag For Election 2024 | Bharatiya Janata Party Symbol

Dear Reader welcome to this blog First of all will share with you the Bharatiya Janata Party Gk which is very helpful for your knowledge after that I will provide today’s topic details “BJP Flag For Election 2024” Below are the full details of BJP flag for car | BJP flag for bike | BJP…

Read moreTamil Nadu CM Thayumanavar Scheme 2024: Online Apply, Eligibility, Benefits

Tamil Nadu CM Thayumanavar Scheme:- A new welfare program was unveiled by the Tamil Nadu government to reduce poverty in the region. The MK Stalin-led DMK administration launched the CM Thayumanavar Scheme. This scheme will be a “final assault on poverty over the next two years. The announcement was made by Tamil Nadu Finance Minister Thangam…

Read moreSGB Allotment Status Check Series IV : Sovereign Gold Bond Issuance Status for Online / Offline Apply

SGB Allotment Status:- There are a few easy ways to find out your allotment status if you apply for the most recent tranche. It is crucial to realize that the procedure of confirming your SGB investments is crucial, regardless of whether you applied for these gold bonds online or offline. On February 12, 2024, the SGB…

Read moreBiju Pakka Ghar Yojana List 2024: Download New Beneficiary List PDF

Biju Pakka Ghar Yojana List:- Today under this article, we will provide our readers with all the information about the Biju Pakka Ghar Yojana for the year 2024. In this article, we will share with the readers the eligibility criteria, beneficiary list, application process, benefits, features, and all of the other details of the Biju Pakka…

Read moreMaha CM Letter Registration @ www.mahacmletter.in to Upload Selfie, Last Date

Maha CM Letter Registration:- 2.11 crore pupils attend Maharashtra’s public schools. In response to a Maha CM Letter that the Chief Minister sent out, the students are asked to post pictures of themselves with their parents and with educational materials. The official website www.mahacmletter.in has set a date of February 17 to February 25, 2024, for the online…

Read moreLucent’s General Knowledge 2024

Lucent’s General Knowledge 2024 PDF book is available online in Hindi and English Latest Edition with New and Updated Content which is very – Useful for all Govt. Exam 2024 in India (Original Copy with Hologram Sticker available for Students.) lucent gk 2024 pdf in English book is useful for every reader in general and…

Read moreCMAT Admit Card 2024 Release Date, Steps to Download, Admit Card Key Details

CMAT Admit Card 2024: NTA will release the CMAT 2024 admit card in the first week of May 2024. Candidates can download the CMAT admit card by visiting cmat.nta.nic.in. For this, candidates must sign in using their registered application number and date of birth. The CMAT exam 2024 is expected to take place in the second…

Read moreLok Sabha Polls 2024: BJP to announce 100 candidates by February-end, sources say

The Bharatiya Janata Party (BJP) will release its first list of at least 100 candidates for the April-May Lok Sabha elections by the end of February, reports said. The list will have names of candidates from seats in states like Uttar Pradesh, West Bengal, Maharashtra and Tamil Nadu, according to a report in Economic Times….

Read moreManorama Year Book 2024 By Sonia Gandhi || India’s Largest Selling GK Updated

Dear Exam Reader, We read last year Manorama year book 2023 and right now a New book coming to the Name of “Manorama Year Book 2024” Below are the main topics of This book, Soon Manorama Year Book 2024 pdf free download also be available for free. MANORAMA YEAR BOOK 2024 EDITION Summary Manorama Yearbook…

Read morePhysics Galaxy 2024 PDF Download | JEE Advanced

Dear Student welcome to this cure18 Today’s blog today will discuss the latest new book released named “Physics Galaxy 2024: JEE Advanced – Physics – Chapter-wise PYQ Analysis by Ashish Arora” The famous Indian writer of this type of exam book. Jee advanced physics galaxy 2024 Summary This very good book Named “Jee Advanced Physics…

Read moreIPL-2024 TEAM FULL DETAILS

Chennai Super Kings Captain: MS Dhoni Coach: Stephen Fleming Home ground: MA Chidambaram Stadium, Chennai IPL titles: 5 (2010, 2011, 2018, 2021, 2023) Owners: Chennai Super Kings Cricket Ltd (subsidiary of India Cements) The most consistent IPL franchise ever, Chennai Super Kings have been led by MS Dhoni to five titles, and have only finished below fourth place twice….

Read moreमहतारी वंदन योजना की पहली किस्त 8 मार्च को, लाभार्थी सूची में नाम चेक करें

Mahtari Vandana Yojana 1st Installment:- छत्तीसगढ़ में महिलाओं को आर्थिक सहायता प्रदान करने के लिए प्रधानमंत्री नरेंद्र मोदी की एक और गारंटी पूरी होने जा रही है। महतारी वंदना योजना के तहत छत्तीसगढ़ सरकार द्वारा महिलाओं को हर महीने 1,000 रुपए की राशि सरकार द्वारा दी जाएगी। इस योजना के तहत अब तक 70 लाख महिलाओं…

Read morePM Modi Yojana 2024: प्रधानमंत्री नरेन्द्र मोदी योजना | सरकारी योजना सूची

PM Modi Yojana के तहत भारत सरकार विभिन्न प्रकार की कल्याणकारी योजनाओं को देश के सभी पात्र लाभार्थियों तक पहुंचा रही है | वर्ष 2014 में प्रधानमंत्री बनने के पश्चात माननीय प्रधानमंत्री श्री नरेंद्र मोदी द्वारा देश हित में बहुत सी योजनाओं का शुभारंभ किया है | आज अपने इस लेख के माध्यम से हम आपको…

Read moreकान में दर्द के कारण और घरेलू इलाज (Ear Pain Treatment In Hindi)

कान का दर्द एक आम बीमारी है जिससे लाखों लोग प्रभावित होते हैं। आमतौर पर यह समस्या सबसे ज्यादा बच्चों में पायी जाती है। कान में दो प्रकार के दर्द होते हैं। एक दर्द कान के अंदर होता है और दूसरा दर्द कान के बाहर होता है जो इस बात का इशारा करते हैं की…

Read moreघुटनों में दर्द — कारण, लक्षण और आसान घरेलू इलाज (Knee Pain In Hindi)

बढ़ती उम्र और शरीर में पोषक तत्वों की कमी जैसे और भी बहुत ऐसे कारण हैं जो घुटनों में दर्द के लिए जिम्मेदार होते हैं। वर्तमान समय में खान पान में इतना ज्यादा बदलाव आ गया है कि व्यक्ति के शरीर को पोषक तत्व निश्चित मात्रा में नहीं मिल पाते हैं जिसकी वजह से यह…

Read moreहरियाणा मुख्यमंत्री मातृत्व सहायता योजना 2024: आवेदन कैसे करें, लाभ व पात्रता

Haryana Mukhyamantri Matritva Sahayata Yojana:- हरियाणा सरकार द्वारा अपने राज्य के लोगों के लिए कई कल्याणकारी योजना चलाई जा रही है। इसी प्रकार हरियाणा सरकार द्वारा महिलाओं के लिए 15 फरवरी को एक नई योजना की शुरुआत की गई है। जिसका नाम मुख्यमंत्री मातृत्व सहायता योजना है। इस योजना के माध्यम से हरियाणा सरकार द्वारा गर्भवती…

Read moreहरियाणा ठेकेदार सक्षम युवा योजना शुरू हुई, 10 हजार युवाओं को मिलेगी स्किल ट्रेनिंग

Thekedar Saksham Yuva Yojana:- हरियाणा के मुख्यमंत्री मनोहर लाल खट्टर जी के द्वारा युवाओं को रोजगार के अवसर उपलब्ध कराने के लिए विभिन्न प्रकार की योजनाओं को संचालित किया जा रहा है। इसी कड़ी में राज्य के शिक्षक बेरोजगार युवाओं को रोजगार के और अवसर उपलब्ध कराने के लिए मुख्यमंत्री ने 15 फरवरी को चंडीगढ़ में…

Read moreKisan Drone Yojana देगी ड्रोन खरीदने पर 5 लाख की सब्सिडी, लाभ एवं पात्रता जाने

Kisan Drone Yojana:- इस समय केंद्र सरकार द्वारा देश के किसानों को तकनीकी खेती से जोड़ने की दिशा में कार्य किया जा रहा है। जिसके लिए अब प्रधानमंत्री नरेंद्र मोदी जी के द्वारा Kisan Drone Yojana की शुरुआत की जा रही है। इस योजना के तहत किसानों को उनके खेत में कीटनाशक एवं पोषक तत्वों का छिड़काव करने…

Read moreIPL Schedule 2024 – Venues, Teams and Their Captain, Key Dates!

IPL Schedule 2024 – Venues, Teams and Their Captain, Key Dates! The IPL 2024 season is likely to unfold between March 23rd and May 29th. With 10 teams vying for the coveted trophy, expect a total of 74 matches to be played, potentially spread across two phases due to India’s general elections scheduled during the same…

Read moreVridha Pension 2023-2024 Status Check, Eligibility, Amount, how to apply?

Vridha Pension 2023-2024 Status Check, Eligibility, Amount, how to apply? An old age pension system has been implemented by the Uttar Pradesh government for the benefit of the state’s elderly population. Senior individuals who qualify for this program will get a monthly pension of ₹500 as financial help, quarterly ₹1500 and annually ₹6000. Vridha Pension 2023-2024…

Read moreNEET UG Application Form 2024, Exam Date, Eligibility, Fee, Apply, neet.nta.nic.in

NEET UG Application Form 2024, Exam Date, Eligibility, Fee, Apply, neet.nta.nic.in The National Testing Agency’s (NTA) official website hosted Registration forms for the National Eligibility and Entrance Test (NEET) exam 2024. This is happen on 09 February 2024. The NEET UG 2024 test has been set for May 5, 2024, as previously announced. NEET UG Application…

Read morePM Kisan Status Check – Beneficiary List, 16th Installment Date, pmkisan.gov.in

PM Kisan Status Check – Beneficiary List, 16th Installment Date, pmkisan.gov.in PM Narendra Modi will give the 16th PM Kisan Installment for farmers in February 2024. You can check the PM Kisan Status Check on the official website that gives small farmers Rs 6000 in three payments. PM Kisan Status Check The Indian government has taken…

Read moreRussian Elections 2024 Date, Candidate, Polls, Result, Winning Prediction

Russian Elections 2024 Date, Candidate, Polls, Result, Winning Prediction May will see the inauguration of the victor, who will be chosen over the course of three days on March 15–17 Russian Elections 2024. The inauguration of the winner will happen on 7 May 2024, however it may be changed if there will be a need…

Read moreMLB The Show 24 Release Date, Availability, Features and Latest Updates!

MLB The Show 24 Release Date, Availability, Features and Latest Updates! MLB The Show 24 release date is out for baseball enthusiasts. San Diego Studio has officially announced the initial release date and all other information like cover player, console, and features of the MLB: The Show series this year. MLB The Show 24 Release…

Read morePearl Jam Dark Matter Tour Dates, Itinerary, Special Guests, Ticket Price

Grunge band will begin on a global tour for the “Dark Matter” album, starting May 8, 2024, at Rogers Arena in Vancouver. The North American leg includes Wrigley Field, Madison Square Garden, and Fenway Park. Pearl Jam Dark Matter Tour Dates North America: May 4, 2024 – Rogers Arena, Vancouver, BC (with Deep Sea Diver)…

Read moreDivya Deshmukh Biography, Chess Career, Early Life and more!

Divya Deshmukh is a rising name in the Indian chess landscape. She comes from the western region of India, Maharashtra. Since childhood, she has begun her journey in the realm of chess. Since then she has grabbed many awards and titles. Her journey inspires many, so today, let’s know her and get inspired by her…

Read moreNUA-O Scholarship Odisha: Benefits, Eligibility, How to Apply?

NUA-O Scholarship Odisha: Benefits, Eligibility, How to Apply? Recently, the Odisha government announced a Nua-O-scholarship for undergraduate and postgraduate students to empower students. The scholarship is a great initiative under the Nutana Unnata Abhilasha (NUA) Odisha scheme. Let’s know what the students will get under this scholarship. NUA-O Scholarship The government of Odisha announced another…

Read moreGMRIT Seats & Fees 2024-25 EXAM

Welcome to GMRIT GMRIT is one of the most reputed colleges of Andhra Pradesh, India, which offers admission to engineering courses in various streams, to get admission into an institution, an individual has to clear the state-level entrance exam. GMR Institute of Technology GMRIT was founded by Grandhi Mallikarjuna Rao in 1997, its campus is located…

Read morePhysics Galaxy 2024 | Physics Galaxy 2023 : Books In Order

Dear Friends, The New book Physics Galaxy 2023 | Physics Galaxy 2024 comes on the market for online sale, which students starting to prepare Jee Advanced Physics Exam, This book is Written By Famous Writer Ashish Arora. Ashish Arora is a master of the Physics Galaxy Series. Below you can Check and Download this book…

Read moreModi The Challenge Of 2024 Book Review Pdf Download

Hello, Dosto New Book COming “Modi The Challenge Of 2024 Book” Everybody know in India – The Indian National Developmental Inclusive Alliance (INDIA), formed by the opposition’s 26 parties, seeks to seriously challenge the BJP-led National Democratic Alliance (NDA) in the 2024 Lok Sabha election. Notwithstanding the ideological divides and cross-regional animosities among the coalition…

Read moreError Pro by Aman Vashishth PDF Free Download

Error Pro by Aman Vashishth PDF Free Download – Aman Vashishth Sir wrote the Error Pro book, which is available for free download. This article’s goal is to give you access to a PDF download for the book Error Pro by Aman Vashishth. Using the following link, you can instantly download and read online the…

Read moreFMGC Solutions 8th Edition पीडीऍफ़ Free Download

Hey, Friend, do You Know What is the Full Form of FMGE? The full form of FMGE is the Foreign Medical Graduates Examination. FMGC Solutions 8th Edition पीडीऍफ़ Free डाउनलोड If you are preparing for the exam you can use the Book Written By famous writers Named Deepak Marwah, and Siraj Ahmad. FMGE Solutions 8th Edition…

Read morePDF Make Epic Money by Ankur Warikoo (Author) Review

Ankur Warikoo नई बुक “Make Epic Money by Ankur Warikoo” revealed this shocking ट्रुथ in his ground-breaking वैरी फेमस book Do Epic Shit: “Three relationships determine our वैरी इजी लाइफ course – time, money, and ourselves.” This Famous book Publisher Name ” Pengun Bussiness” and the Release date of this book in India (27 January…

Read moreQuanta Quantitative Aptitude By Aashish Arora (3662)

Quanta Quantitative Aptitude by Aashish Arora (3662) The book’s material is excellent, and there are many pertinent questions throughout. I sincerely appreciate your efforts and this wonderful surprise. Table of Content Book Written By Aashish Arora Number System Simplification LCM and HCF Average Percentage Profit and Loss Ratio and Proportion Allegation or Mixture Partnership Time…

Read morePoonam Gandhi Bst Class 12 Pdf Download 2023

Poonam Gandhi’s Business Studies book for class 12th follows the current CBSE syllabus for the 2022-2023 school year. The text is written in an easy-to-understand language and is organized in an exam-oriented structure. You can below Poonam Gandhi Bst Class 12 PDF Download 2023 Get Full Book Listen Free on Audible 30-Day Trial Feature…

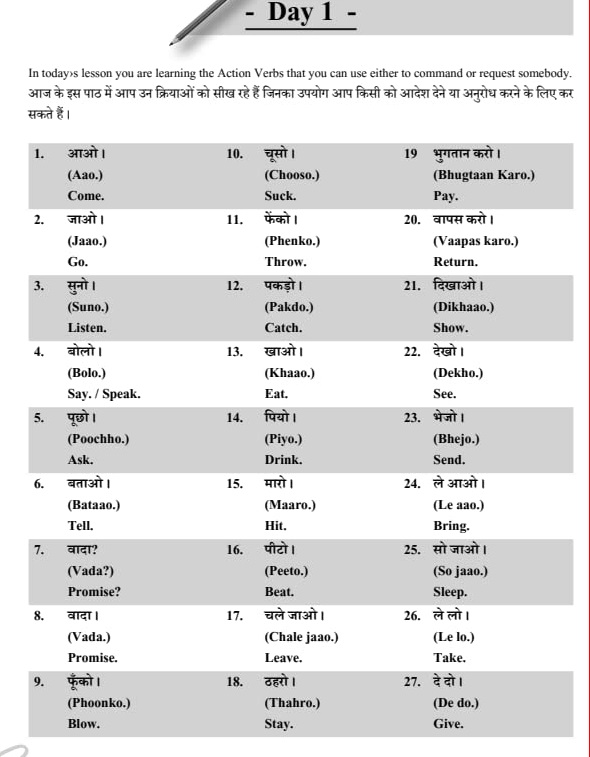

Read more5000 + Daily Use English Sentences By Kanchan Keshari

Dear Reader Welcome to today’s discussion about “5000 + Daily Use English Sentences By Kanchan Keshari” Kanchan Keshari is an Indian very famous English language teacher and founder of the YouTube channel “English Connection by Kanchan Keshari”. She provides spoken English books and training phrases, structures, and lessons to help people improve their English speaking…

Read moreDAMS DVT Pdf Download Ultimate NEETPG Revision Course 2023

DAMS DVT Workbook-Ultimate NEET PG Revision Course. DAMS Visual Treat, DAMS DVT PDF Download!! 20th copy for ultimate revision close to exam for Medical Students and doctors Most highly demanded course for NEET PG is DAMS DVT with a maximum strike rate in NEET PG now is even more powerful with Work Book, full-color images,…

Read moreGagan Pratap Maths Book Chapter Wise Pdf Download

Hey, Friends are you prepared SSC Exam if yes then you are the right blog post and I give you the best author Gagan Pratap Maths Book Chapter Wise PDF Download link in this article. Gagan Pratap sir is a famous name in Mathematics. In this book, you read Math Details Chapter wise 8000+TCS-MCQ. Get…

Read moreIndian Economy by Nitin Singhania Pdf Free Download 3rd Edition | UPSC | Civil Services Exam | State Administrative Exams

Indian Economy by Nitin Singhania Pdf Free Download 3rd Edition | UPSC | Civil Services Exam | State Administrative Exams. the applicants to complete the complex and integrated questions included in this area of the UPSC and other competitive exams. The book aims to explain economic issues and connect them to static economic ideas. Indian…

Read moreThe Sadness Book a Journal to Let Go PDF

The Sadness Book a Journal to Let Go PDF, In The Sadness Book, a guided notebook, the author invites readers to embrace their sorrow, engage in self-examination, and learn to be grateful. Three skillfully written chapters enable you to identify and acknowledge your most profound feelings, invite you to look inside of yourself, and eventually…

Read moreविद्या प्रश्न बैंक कक्षा | Vidya Question Bank Class 10 2024

Dear Student Welcome to this blog! Today’s topic is “Vidya Question Bank Class 10 2024,” a comprehensive question bank for students preparing for the CBSE Class 10 board exams. It is published by Vidya Prakashan, a leading publisher of educational books in India and a very famous Publisher that provides the best book for student…

Read more2024-25- The Indian Economy Sanjiv Verma Latest Edition Pdf

The Indian Economy Sanjiv Verma Latest Edition PDF textbook is designed for students getting ready for exams like UPSC and Civil Services. It’s a beginner-friendly book that makes it easy to understand, even if you don’t know much about the topic. It covers both micro and macroeconomic basics in a good amount of detail. It…

Read moreJockey Inner For Women Under Rs 300, 500, 1000, 1500 More

दोस्तों आज एक पोस्ट में आप देख सकते है Jockey Inner For Women Under Rs 300, 500, 1000, 1500 . आज के टाइम में ऑनलाइन काफी मात्रा में सेलर Sale रहे होते है । अगर आप ब्रांड Lover है तो आप को आज हम फुल डिटेल्स शेयर कर रहे है , यहाँ से आप ऑनलाइन…

Read moreDesi Tarzan Sanjay Phalwan Height, Age, Girlfriend, Wife, Family, Biography & More

Desi Tarzan Sanjay Phalwan, हमारे भारत के उत्तराखंड Sport स्पाटे किंग हैं। उन्होंने 10 घंटे के टाइम में 8100 स्पाटे यानि दंड बैठक मारकर एक विश्व प्रमाणित नया रिकॉर्ड बनाया है। यह संदर रिकॉर्ड उन्होंने हरिद्वार के उत्तराखंड में 2023 था। हम आपको आज बताने जरा रहे है की संजय सिंह Desi Tarzan का जन्म…

Read morePDF Free Download Toppers Study Hacks by Avinash Agarwal

PDF Free Download Toppers Study Hacks by Avinash Agarwal- Free PDF Download of Toppers Study Hacks Greetings, friends! Toppers Study Hacks by Avinash Agarwal PDF Free Download is available in this page. As a result, you can download it in English. Disha Publication is the publisher of this book. Keep an eye on this post and have…

Read more